All about Transaction Advisory Services

Wiki Article

The 25-Second Trick For Transaction Advisory Services

Table of Contents7 Simple Techniques For Transaction Advisory ServicesAll About Transaction Advisory ServicesTransaction Advisory Services Can Be Fun For AnyoneThe 10-Second Trick For Transaction Advisory ServicesTransaction Advisory Services Fundamentals Explained

This action makes certain the service looks its ideal to potential buyers. Obtaining the business's worth right is critical for a successful sale.Deal advisors action in to aid by getting all the needed information organized, responding to inquiries from purchasers, and setting up brows through to business's area. This develops trust with purchasers and maintains the sale relocating along. Obtaining the very best terms is key. Purchase advisors utilize their experience to aid company owner manage challenging arrangements, satisfy customer assumptions, and framework offers that match the owner's goals.

Meeting lawful rules is crucial in any kind of company sale. They aid business owners in intending for their next steps, whether it's retired life, beginning a new venture, or managing their newfound riches.

Purchase consultants bring a riches of experience and expertise, ensuring that every facet of the sale is dealt with skillfully. Via calculated prep work, appraisal, and arrangement, TAS assists company proprietors accomplish the highest possible sale rate. By guaranteeing lawful and regulatory compliance and managing due diligence along with other bargain staff member, deal consultants minimize potential risks and obligations.

The Ultimate Guide To Transaction Advisory Services

By comparison, Large 4 TS groups: Service (e.g., when a potential purchaser is carrying out due diligence, or when an offer is shutting and the purchaser needs to incorporate the firm and re-value the vendor's Equilibrium Sheet). Are with costs that are not connected to the bargain closing successfully. Earn fees per interaction somewhere in the, which is less than what investment financial institutions make also on "little deals" (but the collection chance is additionally a lot higher).

The interview questions are very similar to investment financial meeting concerns, however they'll focus much more on bookkeeping and appraisal and less on subjects like LBO modeling. As an example, anticipate concerns about what the Change in Working Capital methods, EBIT vs. EBITDA vs. Earnings, and "accountant just" subjects like test balances and just how to go through events using debits and credit reports instead of economic statement changes.

The 5-Minute Rule for Transaction Advisory Services

Experts in the TS/ FDD groups might additionally interview management official source about whatever above, and they'll compose an in-depth report with their findings at the end of the process., and the general shape looks like this: The entry-level duty, where you do a whole lot of data and monetary analysis (2 years for a promotion from here). The following degree up; comparable job, but you obtain the more fascinating bits (3 years for a promotion).

In certain, it's hard to obtain advertised beyond the Manager degree because few individuals leave the job at that stage, and you require to begin showing evidence of your capability to create income to development. Let's start with the hours and way of life considering that those are simpler to explain:. There are occasional late nights and weekend job, however nothing like the frantic nature of financial investment financial.

There are cost-of-living adjustments, so anticipate reduced payment if you're in a less costly place outside significant monetary facilities. For all settings other than Companion, the base wage comprises the bulk of the total payment; the year-end bonus could be a max of 30% of your base pay. Frequently, the most effective method to go to these guys boost your earnings is to switch over to a different firm and discuss for a higher income and perk

Little Known Questions About Transaction Advisory Services.

You can get right into company development, but financial investment banking obtains extra tough at this stage due to the fact that you'll be over-qualified for Analyst duties. Business finance is still a choice. At this stage, you must just remain and make a run for a Partner-level duty. If you want to leave, perhaps move to a customer and perform their valuations and due diligence in-house.The major trouble is that because: You generally require to join one more Large 4 team, such as audit, and work there for a few years and after that relocate right into TS, job there for a few years and after that relocate into IB. And there's still no warranty of winning this IB role because it depends upon your area, customers, and the employing market at the time.

Longer-term, there is likewise some risk of and due to the fact that assessing a business's historical economic information is not precisely brain surgery. Check This Out Yes, people will constantly need to be involved, however with advanced innovation, lower head counts might potentially support client involvements. That stated, the Purchase Providers group beats audit in terms of pay, job, and departure chances.

If you liked this write-up, you could be thinking about reading.

Top Guidelines Of Transaction Advisory Services

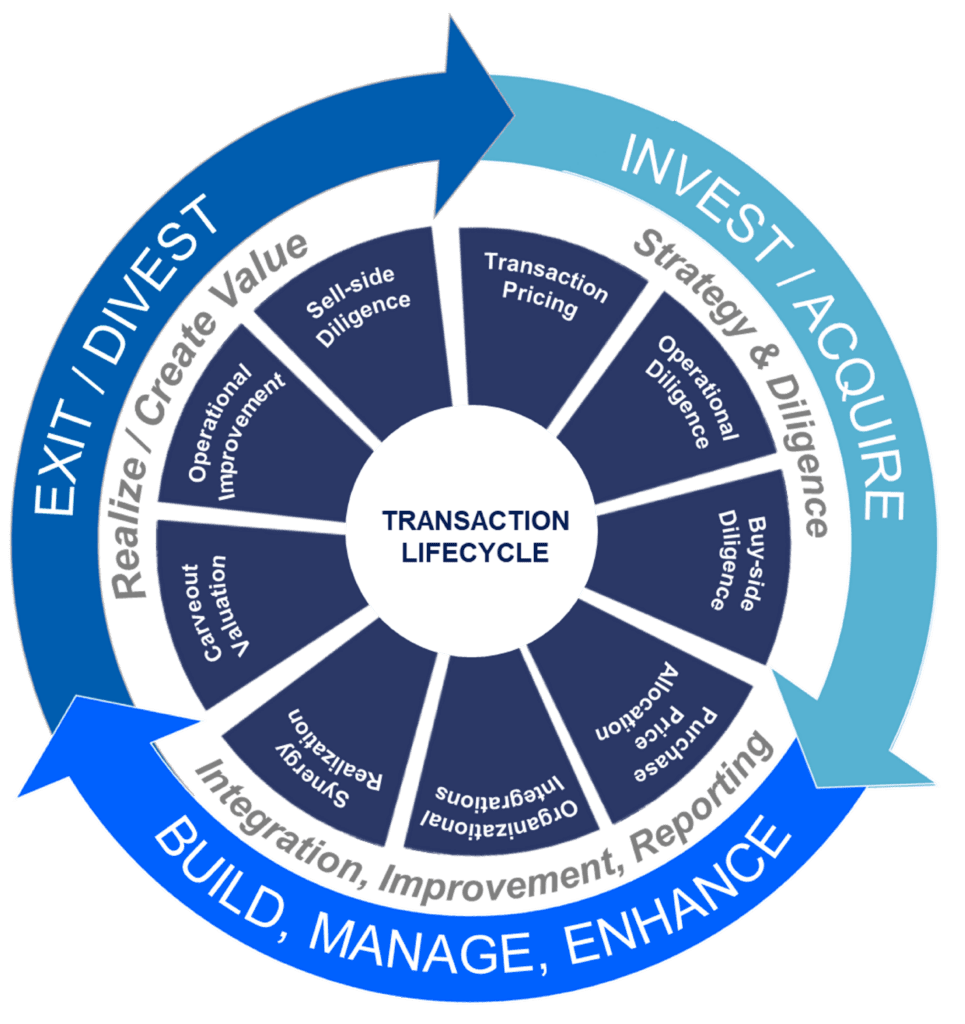

Establish sophisticated monetary structures that help in establishing the actual market value of a company. Give advisory operate in connection to organization evaluation to help in negotiating and pricing structures. Clarify one of the most ideal kind of the bargain and the type of factor to consider to employ (cash money, supply, earn out, and others).

Do integration preparation to determine the process, system, and organizational adjustments that might be needed after the offer. Set guidelines for integrating divisions, modern technologies, and business processes.

Examine the possible consumer base, market verticals, and sales cycle. The functional due diligence uses crucial insights into the functioning of the company to be obtained worrying risk evaluation and value development.

Report this wiki page